Currently, Parliament’s Public Accounts Committee is sitting with discussions centring on gold-related programmes and the financial burden they have placed on the central bank.

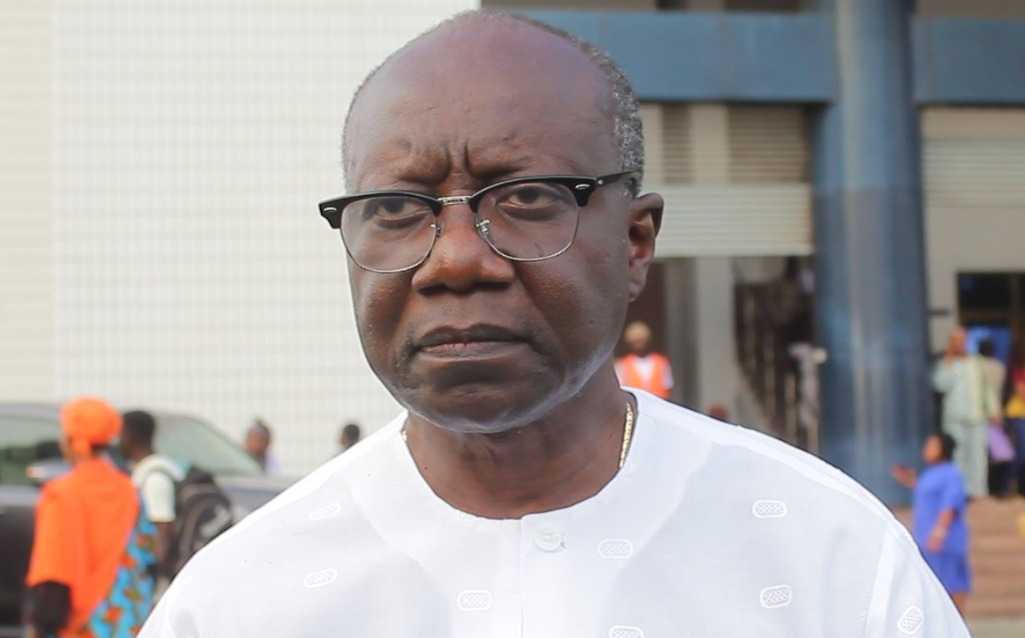

Committee members are questioning how losses linked to these programmes were recorded and who should ultimately bear the cost. Governor of the Bank of Ghana Dr. Johnson P. Asiama explained that gold trading, especially when designed to block smuggling and formalise exports, comes with inherent and unavoidable costs.

While the sittings continue, a new independent technical report by three senior scholars from the University of Ghana indicates that the Ghana Gold Board (GoldBod) has delivered substantial macroeconomic benefits to the country, with gains from reduced gold smuggling and non-debt foreign exchange inflows far outweighing the Bank of Ghana’s reported trading losses.

Titled “Evaluating the Macroeconomic Effects of the Ghana Gold Board (GoldBod)” and dated January 4, 2026, the 50-paged report was co-authored by Professor Festus Ebo Turkson, Peter Junior Dotse, both of the Department of Economics – UG, and Professor Agyapomaa Gyeke-Dako of the Department of Finance, University of Ghana Business School.

The researchers assessed GoldBod’s impact on Ghana’s external sector, fiscal stability and overall macroeconomic performance, and directly compared these gains with the International Monetary Fund-reported Bank of Ghana trading loss of US$214million, and concluded that GoldBod’s macroeconomic benefits exceed the reported cost by a wide margin.

According to the authors, the benefit-to-cost ratio is approximately 18 to 1, with formalisation of just 2.2 tonnes of gold sufficient to offset the reported loss, compared with the much larger volumes actually captured during the year.

Importantly, the report observes mobilising an equivalent volume of foreign exchange through external borrowing would have exposed the country to annual interest costs of between US$756million and US$1.08billion, based on borrowing rates of seven to 10 percent.

Addressing public concerns over the Bank of Ghana’s reported trading loss, the authors argue that the figure has been widely misunderstood.

Much of the loss reflects accounting translation effects rather than actual cash losses, arising from the practice of purchasing gold at near-retail exchange rates to deter smuggling, while booking foreign exchange inflows at the lower interbank rate.

The post Editorial: Matters arising appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS