- as yields compress

- banks to lend more

By Joshua AMLANU & Ebenezer NJOKU

Investors in the local markets are expected to reallocate capital away from short-term government securities toward equities and other risk assets in 2026, as easing inflation and monetary policy cuts compress returns on Treasury bills.

This outlook is outlined by a number of analyses, including those captured in Black Star Group’s 2026 Economic Outlook, ‘The Growth Pivot’.

The report argues that the defensive, yield-driven investment regime that characterised the economy’s stabilisation phase is drawing to a close, requiring a fundamental reassessment of portfolio strategy.

“As we enter 2026, the economic narrative is moving beyond the ‘inflation fight’ toward a decisive macro inflection point,” the Black Star report said – adding that “the cash-heavy, defensive strategies of the past three years are no longer viable”.

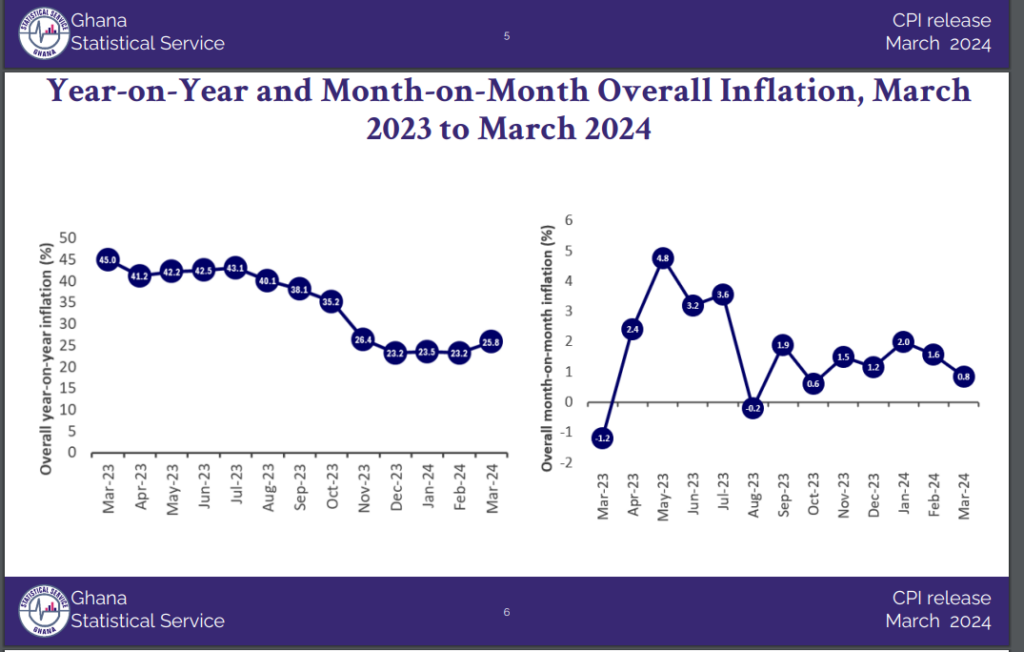

With inflation projected to average about 8 percent in 2026 – having already closed 2025 at about 5.4 percent and the Bank of Ghana (BoG) expected to implement front-loaded policy rate cuts in first-half of the year – real yields on short-term government instruments are expected to narrow sharply.

“This marks a new regime where real returns on short-term government paper compress structurally,” the report said.

“This will necessitate a rotation into asset classes positioned to benefit from easing financial conditions and improving growth dynamics,” it added.

Monetary easing reshaping relative returns

Monetary policy easing is expected to be front-loaded, with significant rate cuts in first-half 2026 as inflation stabilises at single-digit levels.

This is projected to narrow the spread between policy rate and market yields, reducing the relative attractiveness of Treasury bills and other short-duration fixed-income instruments.

“The ‘Growth Pivot’ involves aggressive easing in the year’s first half to realign policy with market yields and stimulate credit,” Black Star said, noting that second-half 2026 will likely focus on liquidity management rather than further sharp cuts.

As yields decline, investors who relied on Treasury bills for risk-free, inflation-adjusted returns during the high-rate period are expected to seek alternatives.

The report characterised this shift as structural rather than cyclical, reflecting a sustained change in the macroeconomic environment.

“Real yield compression is not temporary,” it said, arguing that persistent disinflation will constrain the ability of government securities to deliver the outsized returns recorded in recent years.

These sentiments were echoed by Herman Dela Agbo, Chief Executive of EcoCapital Investment, who said declining borrowing costs are a central driver of the emerging rotation.

Treasury bill rates have fallen into the 8 percent–11 percent range, significantly reducing their appeal relative to equities – some of which posted triple-digit gains in 2025.

“When interest rates drop, the equity market goes. People are no longer interested in doing Treasury bills at 10 percent or 11 percent when you can see single stocks retaining close to 200 percent and in some cases far more. That confidence we saw building through 2025 is likely to carry into 2026,” Mr. Agbo explained.

Beyond relative returns, Mr. Agbo said improving macroeconomic stability is reinforcing investor confidence. Inflation has eased to about 5.4 percent while policy has shifted from crisis recovery toward consolidation, reducing volatility and improving planning for businesses and portfolio managers.

The EcoCapital CEO added that a more predictable exchange-rate environment has also strengthened longer-term projections.

“The strategic effort now is stability. When the economy remains stable, borrowing stays positive and that eventually leads to growth. If we can hold the economy where it is, businesses can plan, expand, recruit and generate more revenue for shareholders,” he noted.

From a portfolio perspective, Mr. Agbo said equities remain the preferred option for investors with longer time horizons – given their tendency to outperform inflation over time.

Fixed income, he noted, still plays a role – particularly for liquidity management and short-duration needs – but its dominance has waned as real returns have narrowed.

He also pointed to structural features of Ghana’s capital markets, including limited depth of the corporate bond market and small number of listed equities, arguing that these constraints can make stock selection easier for informed investors.

However, he cautioned against blanket recommendations – urging investors to seek professional advice to align asset allocation with individual risk tolerance, particularly as Ghana prepares to exit its International Monetary Fund programme.

Equities deepen relevance

Ghana Stock Exchange (GSE) is expected to be a primary beneficiary of the changing interest rate environment. The Accra bourse continued its strong multi-year run, closing 2025 with a 79.4 percent return and a market capitalisation of GH¢172billion.

Equity valuations remain relatively attractive compared with historical averages and regional peers, despite improving corporate earnings and balance-sheet repair.

“As real returns on fixed income compress, capital rotates decisively into equities,” Black Star said, projecting stronger equity market performance in 2026.

Listed companies with exposure to domestic consumption, services and financial intermediation are expected to benefit from lower borrowing costs and improving demand conditions.

Banking, telecommunications, education and consumer goods are identified as key sectors positioned to capture the upside of the growth environment.

Improved system liquidity is also expected to support trading volumes, reversing the subdued market activity observed when high-yield government securities dominated investor attention.

Banks face margin pressure, pivot to lending

The anticipated shift in investor behaviour is expected to have important implications for the banking sector. While banks benefitted from elevated interest rates and strong returns on government securities during the stabilisation phase, the report warns that this income model will come under pressure as rates decline.

“Without a material acceleration in lending, bank net interest margins are likely to compress as asset yields fall faster than funding costs,” the Black Star report said.

As returns on government securities decline, banks are expected to reduce exposure to short-term paper and increase private-sector lending to sustain profitability, supporting credit growth aligned with the broader economic recovery.

Risks remain

Despite the constructive outlook, both analyses highlighted fiscal discipline as a key risk – particularly following the expected conclusion of Ghana’s IMF programme. Historical slippage could reignite inflationary pressures and disrupt the interest rate trajectory.

External risks include weaker commodity prices, higher global interest rates and renewed financial market volatility, while domestic political pressures could also affect bond markets and investor sentiment if not carefully managed.

The post Investors to rotate from T-bills to equities in 2026 appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS