Most people invest without ever thinking about how the system behind their money actually works. When you buy into a mutual fund, ETF, or closed-end fund, you are relying on investment companies to pool your money with thousands of others and manage it on your behalf. These funds promise diversification, expert management, and simplicity.

But behind the scenes, the U.S. investment fund industry has grown so large, and so interconnected, that regulators and economists are increasingly worried about something that sounds complex but affects everyone: systemic risk.

Systemic risk simply refers to the danger that one part of the financial system can collapse and pull everything else down with it. Many of the warnings today focus on what is often called the “shadow-banking system.” Shadow banks are financial players that perform bank-like activities, such as lending, liquidity transformation, or high-frequency market making, but without the same strict regulations as traditional banks.

Investment funds are not banks. They don’t take deposits. They don’t have physical branches. But the way modern finance works, certain funds now behave like banks—engaging in liquidity transformation, using leverage, borrowing short and investing long, and relying on fragile market structures.

This means that a sudden shock, such as rapid withdrawals, market downturns, or liquidity shortages, could cascade through the system, affecting not just investors but the wider economy.

Understanding Investment Company Funds: The Basics

Investment company funds can be broadly categorized into three main structures: mutual funds, closed-end funds, and exchange-traded funds (ETFs).

Mutual funds, also known as open-end funds, allow investors to buy or sell shares at the fund’s net asset value (NAV) at any time. The fund is obligated to meet all redemption requests, regardless of prevailing market conditions. This promise of liquidity can create risks during periods of market stress, as the fund may be forced to sell assets at unfavorable prices to meet investor withdrawals.

Closed-end funds (CEFs) differ from mutual funds in that they issue a fixed number of shares that trade on exchanges like regular stocks. Because the share price is determined by market supply and demand, it may differ from the fund’s NAV. Many closed-end funds also use leverage to enhance returns, which can increase volatility and magnify losses during market downturns.

Exchange-traded funds (ETFs) trade like individual stocks throughout the day and use unique creation and redemption mechanisms that rely on a small number of authorized participants (APs).

While this structure generally works well under normal market conditions, it has demonstrated fragility during periods of market stress when APs may withdraw, potentially causing large discrepancies between market prices and NAV.

Within these fund structures, certain fund types dominate the investment landscape. Growth funds invest primarily in companies that are expected to grow rapidly, often prioritizing capital appreciation over income.

Growth and income funds combine the potential for capital appreciation with dividend income, providing a balanced return profile. Balanced funds hold a mix of stocks and bonds to reduce overall portfolio risk through diversification, while income funds focus on generating steady income, typically through bond investments.

Specialized funds concentrate on narrow industries or unique investment strategies, and sector funds target specific industries, such as technology or healthcare. Index funds aim to replicate the performance of a particular market index, whether broad or narrow, offering a low-cost, passive investment strategy. Asset allocation funds adjust their holdings dynamically based on market conditions, seeking to optimize returns while managing risk.

Finally, international or global funds invest outside the United States, providing geographic diversification but exposing investors to currency fluctuations and foreign market risks. Why Systemic Risk Has Grown in Investment Funds

Several trends have transformed the fund ecosystem into something larger, faster, and more interconnected:

Explosive Growth of Assets Under Management (AUM)

U.S. investment companies now manage more than $30 trillion. When markets move rapidly, such enormous pools of money can amplify volatility.

Liquidity Mismatch

Many funds invest in assets that do not trade frequently (e.g., corporate bonds) while promising daily liquidity to investors.

This creates bank-like fragility: if investors rush to exit, funds may have to sell illiquid assets at fire-sale prices.

Rise of ETFs and Algorithmic Trading

ETFs rely heavily on a small group of “authorized participants” to keep prices aligned with NAV. If APs step back during a crisis, the structure can break down, causing price distortions.

Use of Leverage

Some closed-end funds and specialized funds borrow money to boost returns. Leverage magnifies losses and can create spillovers when markets fall.

Herding Behavior from Passive Investing

Index funds and ETFs now account for more than half of U.S. equity fund assets.

When everyone follows the same index, buying and selling patterns become synchronized, leading to concentrated risks.

How Risks Differ Across Major Fund Types

Shadow-banking concerns manifest differently across various fund categories, depending on the type of investments they hold and their liquidity structures.

Growth Funds and Growth & Income Funds typically hold stocks that can be highly volatile. These funds are particularly vulnerable to investor panic during market downturns. In recessions or periods of sharp declines, these funds often experience rapid outflows, forcing managers to liquidate positions, which can further intensify market declines.

Balanced and Asset Allocation Funds generally hold a mix of stocks and bonds, which theoretically reduces risk through diversification. However, the bond portion of these funds can become illiquid during periods of market stress. When both stocks and bonds decline simultaneously, as occurred in 2022, these funds face what is known as a “double-drawdown” risk, where losses in multiple asset classes occur concurrently.

Income Funds, particularly bond funds, present some of the most significant systemic risks in the investment fund sector today. These funds promise daily liquidity to investors, but many of the bonds they hold do not trade daily, creating a liquidity mismatch.

This mismatch effectively transforms bond funds into shadow-bank-like entities, because they borrow short through liquidity promises while investing long in illiquid securities. During market shocks, forced sales of bonds can freeze the credit system, as seen during the 2013 “Taper Tantrum” and the 2020 COVID-19 bond market crisis.

Specialized and Sector Funds are highly concentrated and extremely volatile because they focus on narrow industries. This concentration amplifies risk within those sectors and can create mini-bubbles, particularly in high-growth or speculative areas such as technology, energy, or biotechnology.

Index Funds and Exchange-Traded Funds (ETFs) are often perceived as safe because they passively track market indexes. However, these funds are not without risks. One major concern is herding behavior, where many investors buy or sell the same securities simultaneously, which can destabilize markets.

During times of stress, prices can disconnect from underlying values, and ETFs depend heavily on a small group of authorized participants to manage creation and redemption of shares. If these participants withdraw during a crisis, ETF pricing can break down dramatically.

International and Global Funds face unique risks because they are exposed to currency fluctuations and rely on the stability of foreign markets. These funds are also vulnerable to geopolitical shocks and often hold less liquid assets compared to U.S.-based funds. Collectively, the vulnerabilities across these fund types contribute to systemic risks that regulators have increasingly highlighted.

The Rise of “Shadow-Bank” Behavior in Investment Funds

Although investment funds are not formally classified as banks, many now engage in activities traditionally associated with banking, including liquidity transformation, maturity mismatches, leverage, reliance on wholesale funding, high-speed trading, and continuous price discovery. These behaviors mirror classic shadow-bank characteristics, making funds potential sources of systemic risk.

Why This Matters is that traditional banks operate under strict regulations, such as capital requirements, liquidity mandates, stress tests, and deposit insurance, which help mitigate risk. Investment funds, by contrast, are not subject to these safeguards.

When market shocks occur, funds can trigger fire-sale liquidations, unstable market swings, credit crunches, and contagion across broader markets. Historical events illustrate this risk, including the 2008 money market fund collapse, the 2013 bond market panic, and the 2020 Federal Reserve intervention required to stabilize bond ETFs. The more that funds operate like banks without the regulatory protections of banks, the greater the potential for systemic disruptions.

Regulatory Concerns and Responses

Regulators are aware of the growing risks associated with investment funds and have taken several steps to address them.

The SEC’s Liquidity Risk Management Rules require funds to classify assets according to liquidity buckets and to maintain a portion of their portfolios in highly liquid form. However, many critics argue that these rules are insufficient, as they often underestimate stress scenarios, overestimate market liquidity, and may allow funds to manipulate liquidity classifications.

Stress-testing requirements have been introduced for certain funds, but the coverage remains limited, leaving some categories of funds vulnerable to unexpected shocks.

Proposals for swing pricing aim to shift costs to exiting investors during periods of market stress, reducing the incentives for runs on funds. However, implementation in the U.S. has been challenging due to operational complexity.

Regulators are also exploring ways to improve transparency for ETF authorized participants, who play a critical role in maintaining ETF liquidity. Overall, the regulatory framework is improving, but significant gaps remain, particularly in areas such as bond funds and leveraged fund structures.

Conclusion

The U.S. investment fund industry remains one of the strongest and most innovative in the world. It has democratized investing, reduced costs, and helped millions build wealth. But the very features that make funds attractive, daily liquidity, passive investing, specialized strategies, and high-speed trading, also create new systemic risks.

As funds increasingly resemble shadow banks, regulators, investors, and policymakers must rethink how liquidity, leverage, and cybersecurity are managed. The goal is not to limit innovation but to ensure stability, so that ordinary investors, retirees, and savers are protected from shocks that could ripple through the entire financial system.

A safer future requires clearer rules, stronger oversight, improved cybersecurity, and more transparency. Investment companies have become too central to modern finance to be treated as simple vehicles, they are now critical infrastructure.

References

Bank for International Settlements. (2021). ETF trading and market liquidity in times of stress. BIS Quarterly Review. https://www.bis.org

BlackRock. (2020). Lessons from the liquidity crisis: ETF market structure and performance in 2020. BlackRock Investment Institute.

Bouveret, A. (2017). Liquidity stress tests for investment funds: A macroprudential approach. International Monetary Fund. https://www.imf.org

Financial Stability Board. (2020). Global monitoring report on non-bank financial intermediation 2020. https://www.fsb.org

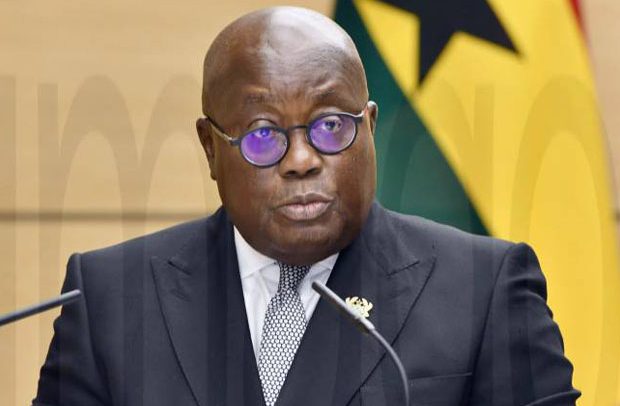

The post Financial Security (FinSec) series with Dr Philip Takyi: Beyond the surface: How growing systemic risks and shadow-bank trends are reshaping US investment funds—from growth funds to index funds appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS