The Bank of Ghana (BoG) has announced the successful completion of the first Proof of Concept (PoC) as part of Project, Digital Economy Semi-Fungible Token (DESFT) which demonstrates the successful execution of a cross-border transaction payment making use of digital credentials, the eCedi and an approved stablecoin from Singapore.

The BoG in collaboration with the Monetary Authority of Singapore (MAS) initiated Project DESFT in June 2023.

The first Phase of the project saw the design and development of a trusted credential system that enables SMEs to transform key information such as basic credentials, licences, certificates, and trade records into verifiable digital credentials on a secure distributed ledger system, allowing potential trade partners and financial institutions to efficiently verify the authenticity of such information.

Expanding upon this groundwork, in April 2024, Phase 2 of the Project DESFT successfully executed a cross-border trade between Ghana and Singapore, leveraging the DESFT solution, Universal Trusted Credentials (UTC), a Singapore Stablecoin (xSGD), the recently piloted Ghanaian Central Bank Digital Currency (CBDC), the eCedi, and the Purpose

Bound Money (PBM) protocol.

The live transactions, according to the BoG, further demonstrated the feasibility of utilizing the proposed Ghanaian domestic retail CBDC platform, the eCedi in cross-border transactions.

“This affirms the potential of the eCedi system demonstrated for future interoperability with various cross-border credential and payment platforms,” the central bank said.

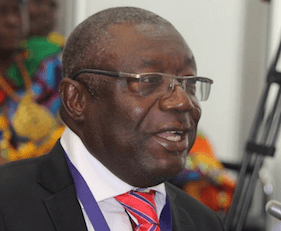

The Director of FinTech and Innovation Office at the Bank of Ghana, Mr Kwame Oppong in a remark during the press launch of the successful completion of cross-border trade using digital credentials at the just ended 31 Africa Summit in Accra on Thursday, May 15 said “The prospective introduction of the eCedi is poised to significantly enhance Ghana’s dynamic payment ecosystem, fostering inclusive growth and innovation while improving consumer experiences. With its interoperability with the DESFT system, and verifiable credentials via UTC, the eCedi has the potential to facilitate the participation of Ghanaian Micro, Small, and Medium Enterprises (MSMEs) in international trade in a cost-effective manner.

“Project DESFT is aimed at supporting SMEs in Africa to engage in international trade by removing significant obstacles they face, such as establishing trust with overseas trade partners and obtaining support in cross-border payments and supply chain finance. We believe that the new generation of financial technology offers innovative approaches to

these challenges. After nearly a year and two phases of development, we have crafted a reliable information exchange solution founded on UTC standards and Semi-fungible Token technology.

“Furthermore, we have rigorously tested a cross-border payment solution built upon the principles of Purpose Bound Money (PBM) and conducted real trade experiments which fully align with our predetermined objectives.

“The next phase of the Project DESFT will continue to build upon the current achievements, focusing on highly automated digital credential processes, programmable payments across multiple digital currencies, and support for supply chain finance.”

The post eCedi to significantly enhance Ghana’s dynamic payment ecosystem – Bank of Ghana first appeared on 3News.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS